The Influence of Software on Training

This may sound like a familiar topic of discussion, “how will we onboard and train new employees in utility and tax accounting?” It can take decades of experience to fully understand the intricacies of tax depreciation and deferred taxes, work order closing calculations, book asset and depreciation computations, ARO accretion and liabilities, integration best practices, and more. This knowledge base is complex and can be difficult to efficiently transfer to a new generation.

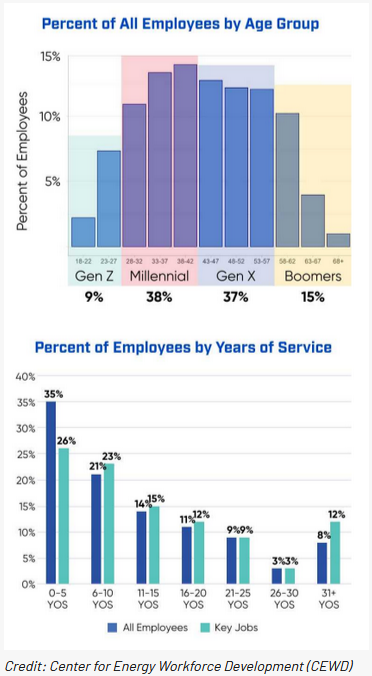

In 2023, the Energy Workforce Survey, implemented by the Center for Energy Workforce Development (CEWD), found that even though the “gap” of an aging workforce has been addressed it has been replaced by a new challenge – how to develop the knowledge and skills of the new workforce. The graph below shows over 50% of industry is comprised of Generation X and Boomers, but Millennials now make up the single largest group. In addition, the Key Jobs at an organization still lean towards those with more experience in the industry.

Therefore, the question remains, how to most efficiently transfer the knowledge to the next generation of employees?

Formal training is too often the proposed solution. In 2023 a survey by Axonify found that 43% of employees find formal training ineffective. Not surprisingly, they found most employees prefer to learn while on the job performing real tasks. Research.com had similar findings in 2024, reporting that 68% of employees prefer to learn or train in the workplace. In addition, a 2019 survey by the Workplace Learning Report discovered that 94% of employees would stay at a company longer if the company invested in their learning and development.

Therefore, if formal training is not the answer and employees prefer training on the job, then it is imperative to have a software solution for tax and asset accounting that facilitates and encourages a learning and development atmosphere.

Arctek

Arctek, by Arc-Two, not only has the features and functionality for a full book and tax accounting system, but has also taken the extra step, by enabling a learning environment for the next generation.

No Black Box Calculations

Key industry calculations such as AFUDC, Tax and Book Depreciation, and ARO Liabilities do not just spit out a number that a user is to blindly accept, or worse, provide no insight into changes month over month. Each calculation in Arctek is delivered with a clear analysis of the data and configurations that generated the answer. In addition, those details are kept in perpetuity with the calculated numbers themselves for historical review.

Clear data, configuration, and calculations is a great first step, but Arctek goes further with calculation messages at key processing points or unique milestones. As an example, say there is a work order where AFUDC is configured to turn off after 3 months of inactivity. Instead of just showing $0 of AFUDC for that month, three months of no activity, and the configuration option that shows AFUDC should be turned off after 3 months, Arctek provides an unambiguous message to the user to summarize it all together: “AFUDC has been turned off because there has been 3 months of inactivity.” These messages can be found throughout the system.

An employee no longer requires 20 years of experience in the industry or experience with a particular software in order to understand how a system calculates an answer.

Comprehensive Drilldown

The flow of data through the various lifecycles, from work order activity to book assets or book assets to tax depreciation, can be daunting to follow. It can take years of industry knowledge to understand the different allocations, mappings, and configurations that define how data moves from one spot in the life cycle to another. Often times, this requires knowledge of specific reports with specific filters, exports to Excel, and then manually tying out between files. Again, knowledge that is not easily shared.

Arc-Two believes tying out data between different life cycle points should be intuitive and easily accomplished from within the software. Throughout the system there is drilldown capability at the user’s finger tips to the details in the previous point in the data life cycle. A user can track where data originated and how it was mapped or allocated to get to the next step. Intuitively and deliberately providing this functionality counteracts reliance on a single power user knowing (or guessing) exactly how a system works.

Step by Step Wizards and Streamlined Navigation

Sometimes industry knowledge is not just about tax and book accounting, it is simply where to go in a system to perform an action. A common question in accounting software you may hear between employees is “Where can I find…?” It should not take years of experience to simply find a certain page in a system.

Arctek’s modern layout, wizard-based processes, and wheel-and-spoke navigation have begun to eliminate this question. A streamlined approach to the user interface allows even a novice user to find their way through the system and discover the functionality they need. Knowledge transfer between employees should be much more about how the industry and accounting work, not having to memorize obscure locations to navigate within a system.

When thinking about your book and tax accounting solution, remember to think about how it can impact on-boarding and training of the next generation.